A profound transformation is reshaping America’s financial landscape. Young adults are actively turning away from traditional wealth-building methods and embracing alternative investment strategies at unprecedented rates. This shift reflects not just changing preferences but a fundamental rethinking of how future generations plan to build financial security.

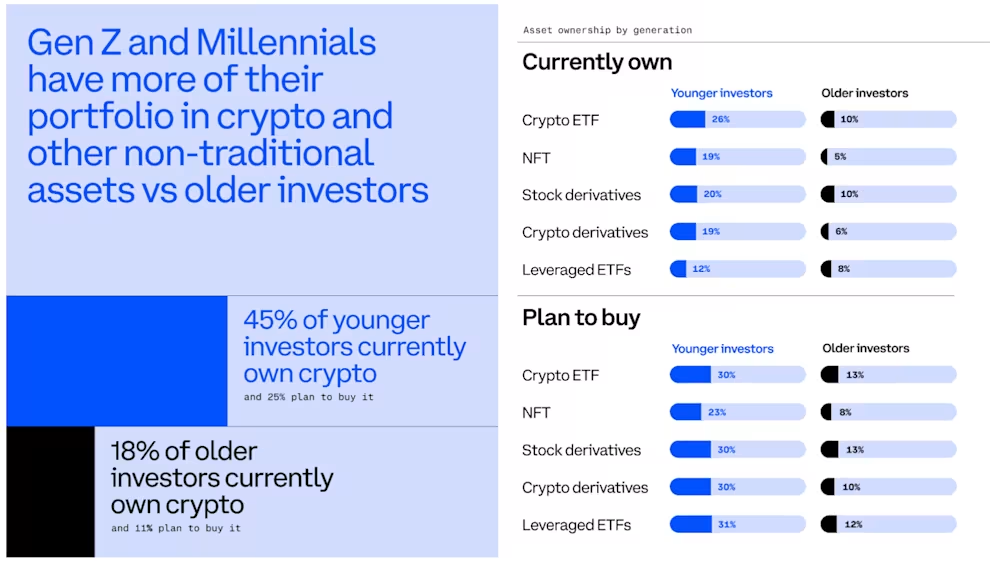

According to Coinbase’s latest State of Crypto report, younger investors now allocate three times more of their portfolios to non-traditional assets than older generations. The data reveals that 45% of younger US investors already own cryptocurrency, compared to just 18% of older investors. This striking contrast highlights how differently generations approach wealth creation in today’s economy.

For many young adults, this pivot toward alternative assets stems from feeling excluded from conventional wealth-building paths. Rising housing costs, student loan burdens, and stagnant wages make traditional milestones like homeownership seem increasingly unattainable. Instead of giving up on financial growth, they’re charting new courses through digital assets, collectibles, and other alternative investments.

There’s a generational shift happening.

— Coinbase 🛡️ (@coinbase) December 16, 2025

Young adults:

→ Feel locked out of the old wealth ladder

→ Are allocating 3x more to non-traditional assets than older investors

→ See crypto as a core part of their economic future pic.twitter.com/gTU81ZSkZ6

The Digital Asset Revolution

Young investors view cryptocurrency not merely as a speculative gamble but as a central component of their financial future. The appeal extends beyond potential returns to include the transparency, accessibility, and decentralized nature of blockchain-based assets.

Unlike previous generations who primarily built wealth through real estate and traditional stock portfolios, younger investors embrace digital assets as a core strategy. They appreciate the 24/7 market access, fractional ownership possibilities, and freedom from many institutional barriers that characterized older financial systems.

Matthew Bartlett, Head of Web3 & NFT Community at VanEck, notes that these assets offer something previous generations rarely prioritized: “A wallet can function as both a portfolio and a social signal. That might feel unusual from a traditional finance perspective, but it’s second nature to people who grew up online.”

This integration of financial and cultural value creates strong attachment to crypto assets among younger investors. They don’t just see numbers on a screen—they see membership in communities that share their values and vision for the future.

Beyond Crypto: The Alternative Asset Landscape

While cryptocurrency dominates headlines, young investors are diversifying across various alternative assets. According to Bank of America research, alternatives comprise 31% of younger investors’ portfolios compared to just 6% for older generations.

Private equity investments, once reserved for institutional investors, now attract significant interest from younger individuals. Nearly 26% of Millennials expressed interest in increasing their private equity exposure, with many utilizing new platforms that allow fractional investment in previously inaccessible opportunities.

Collectibles also hold strong appeal, with 94% of Gen Z and Millennials expressing interest in tangible assets like art, vintage items, and luxury goods. These investments offer both potential appreciation and emotional connection—blending financial strategy with personal values in ways traditional investments rarely achieve.

Young investors combine digital fluency with value-driven decision making. They leverage multiple platforms simultaneously, often holding accounts with both established firms like Fidelity and newer entrants like Robinhood, to build diversified portfolios tailored to their financial goals and ethical priorities.

Redefining Success On Their Own Terms

The shift toward alternative investments reflects more than different asset preferences—it signals a fundamental rethinking of financial success itself. Young adults aren’t simply choosing different investments; they’re redefining what financial achievement means.

For many in these generations, success includes flexibility, portability, and alignment with personal values. Traditional markers like homeownership haven’t disappeared from their goals, but they no longer represent the primary path to security. Instead, they seek financial strategies that adapt to changing work patterns, geographic mobility, and evolving life priorities.

The financial industry has begun responding to these changing preferences. Major institutions increasingly offer cryptocurrency exposure, alternative investment options, and digital-first services. Advisory firms report growing demand from younger clients for guidance on integrating traditional and alternative assets into cohesive strategies.

Perhaps most importantly, this generational shift challenges long-held assumptions about risk. Young investors often view traditional markets as carrying their own significant risks, especially given experiences through multiple economic crises. Their approach to alternatives reflects not recklessness but a different risk calculation based on their lived experiences.

A 2024 Policygenius survey found Millennials and Gen Z are just as likely to own cryptocurrency (21%) as real estate (20%). But that parity signals more than coincidence, it marks a generational shift in how wealth is built and where trust is placed.

— Propy (@PropyInc) July 8, 2025

According to Gemini, 51% of… pic.twitter.com/lPkT1iv8iB

Navigating Tomorrow’s Financial World

As younger generations gain economic influence, their investment approaches will likely reshape market structures and financial services. Traditional institutions and newer fintech platforms continue adapting to serve these evolving preferences.

The generational wealth shift represents more than changing preferences—it signals a fundamental evolution in how Americans build financial security. Young adults haven’t abandoned the goal of building wealth; they’ve simply recognized that yesterday’s roadmaps may not lead to tomorrow’s success.

For financial professionals, understanding this shift means looking beyond asset allocation to recognize the values and priorities driving young investors’ decisions. The most successful advisors will be those who appreciate that younger clients aren’t simply seeking different assets but building entirely new relationships with money and wealth.

As we watch this transformation unfold, one thing becomes clear: the financial system isn’t simply changing its components—it’s undergoing a comprehensive update with younger generations leading the way. Their approaches to wealth building will likely define economic patterns for decades to come.

Disclaimer: News content provided by Genfinity is intended solely for informational purposes. While we strive to deliver accurate and up-to-date information, we do not offer financial or legal advice of any kind. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial or legal decisions. Genfinity disclaims any responsibility for actions taken based on the information presented in our articles. Our commitment is to share knowledge, foster discussion, and contribute to a better understanding of the topics covered in our articles. We advise our readers to exercise caution and diligence when seeking information or making decisions based on the content we provide.