MetaMask has introduced Transaction Shield, a premium security feature that offers up to $10,000 monthly protection against transaction losses. This new subscription service provides users with enhanced confidence when navigating the often risky world of cryptocurrency transactions. For $9.99 per month or $99 annually, users gain access to both transaction protection and priority support.

The feature comes at a time when crypto security concerns remain prevalent. Despite improvements in wallet security, users still face risks when signing transactions across decentralized applications. Transaction Shield adds an additional layer of protection to MetaMask’s existing security infrastructure.

Now introducing Transaction Shield 🦊🛡️

— MetaMask.eth 🦊 (@MetaMask) December 2, 2025

Our newest opt-in feature gives you added confidence on top of the security MetaMask already provides. 👇🧵 pic.twitter.com/nqg8rokwMk

How MetaMask Transaction Shield Works

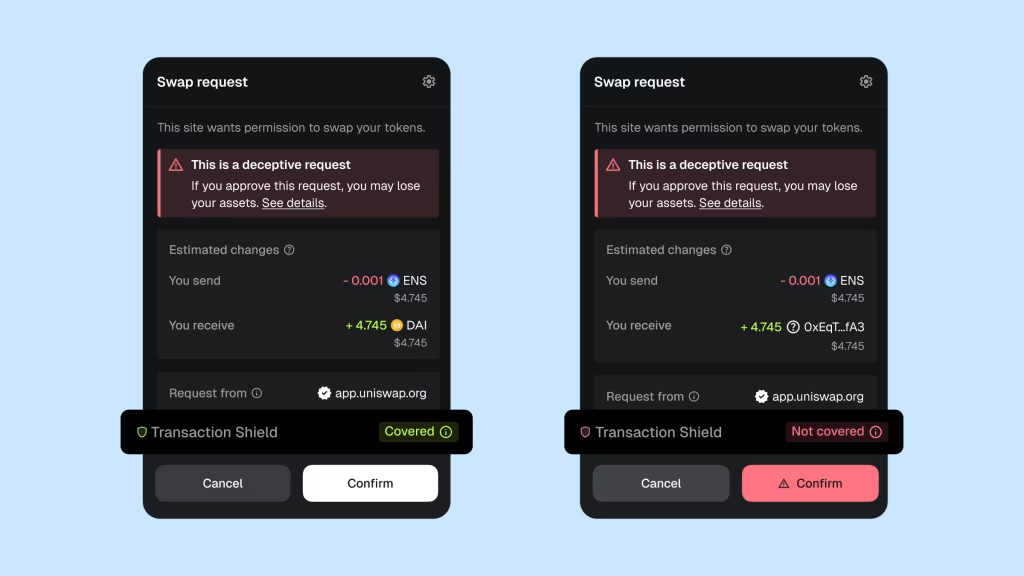

Transaction Shield builds upon MetaMask’s existing security stack, which already includes automated transaction simulations and contract safety checks. When you subscribe to the service, you receive clear in-app alerts showing which transactions qualify for protection. The system only covers transactions that MetaMask has deemed safe through its security checks.

If a covered transaction later results in asset loss despite being flagged as safe, subscribers can submit a claim within 21 days of the incident. Most approved claims are processed within 15 business days, with reimbursements paid in mUSD (MetaMask’s dollar-denominated asset) directly to your specified wallet address.

This protection applies to up to 100 eligible transactions per month, with a combined coverage limit of $10,000. Users can try Transaction Shield with a 14-day free trial before committing to the subscription. Annual subscribers receive a $20 discount compared to the monthly payment option.

Supported Networks and Transaction Types

Transaction Shield currently works on the MetaMask browser extension, with plans to extend support to the mobile app in the future. The service covers transactions across major blockchain networks including Ethereum, Linea, Arbitrum, Avalanche, Optimism, Base, Polygon, BNB Chain, and Sei.

Not all transaction types qualify for protection. Eligible interactions include token swaps on verified platforms like Uniswap or 1inch, lending activities on protocols such as Aave or Lido, NFT minting or selling on trusted marketplaces like OpenSea, and claiming airdrops from verified smart contracts.

This focused approach ensures that common user activities receive protection while maintaining reasonable risk parameters. Users should still review all transaction prompts carefully, as the service only covers transactions that MetaMask has specifically marked as safe.

Protection Limitations and Exclusions

Transaction Shield is not comprehensive wallet insurance. Important exclusions apply that users should understand before relying on this protection. The service does not cover losses from phishing attacks, malware infections, leaked or stolen Secret Recovery Phrases, or compromised private keys.

Additionally, the protection excludes financial losses from normal market movements, such as tokens dropping in value after a trade or insufficient liquidity affecting transaction outcomes. Protocol-level exploits that impact DeFi platforms after you’ve deposited assets also fall outside the coverage scope.

These limitations highlight that Transaction Shield specifically addresses misclassifications by MetaMask’s own screening systems rather than providing blanket insurance against all possible crypto hazards. Users retain responsibility for basic security practices like safeguarding seed phrases and avoiding suspicious websites.

The Claim Process

Filing a claim under Transaction Shield follows a straightforward process. From the MetaMask Extension, users navigate to Settings, select the Transaction Shield section, and submit details about the affected transaction. The system requires specific information about the transaction and wallet to process the claim.

MetaMask evaluates each claim against its protection criteria, verifying that the transaction was flagged as safe by their systems before the loss occurred. Claims must be submitted within 21 days of the transaction, and most approved claims receive payment within 15 business days.

The streamlined claims workflow represents a significant step toward consumer-style protection in the cryptocurrency space, where recovering lost funds has traditionally been difficult or impossible. This approach gives users a clear timeline and process for seeking reimbursement when covered losses occur.

Advancing Wallet Security Standards

MetaMask’s Transaction Shield marks an evolution in how wallet providers approach user protection. Instead of relying solely on passive warnings or domain blocklists, this model provides active guarantees with financial backing. This shifts some transaction risk from individual users to the platform when using the premium service.

While the $10,000 monthly cap might not cover high-value transactions for power users, it offers meaningful protection for most retail cryptocurrency participants. The service acknowledges that even with advanced security features, transaction risks remain in the blockchain ecosystem. By offering a paid path to mitigate these risks, MetaMask provides options for users seeking additional security assurances.

The introduction of Transaction Shield represents a broader industry trend toward more robust consumer protections in cryptocurrency. As blockchain adoption grows, users increasingly expect safeguards similar to those in traditional financial services. MetaMask’s approach balances the self-custody ethos of cryptocurrency with practical protection mechanisms that may help attract more mainstream users to decentralized finance.

Disclaimer: News content provided by Genfinity is intended solely for informational purposes. While we strive to deliver accurate and up-to-date information, we do not offer financial or legal advice of any kind. Readers are encouraged to conduct their own research and consult with qualified professionals before making any financial or legal decisions. Genfinity disclaims any responsibility for actions taken based on the information presented in our articles. Our commitment is to share knowledge, foster discussion, and contribute to a better understanding of the topics covered in our articles. We advise our readers to exercise caution and diligence when seeking information or making decisions based on the content we provide.